What is hundred percent commission real estate?

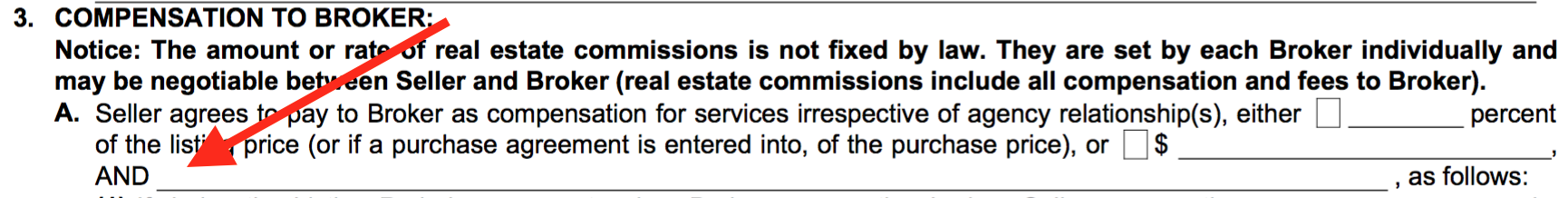

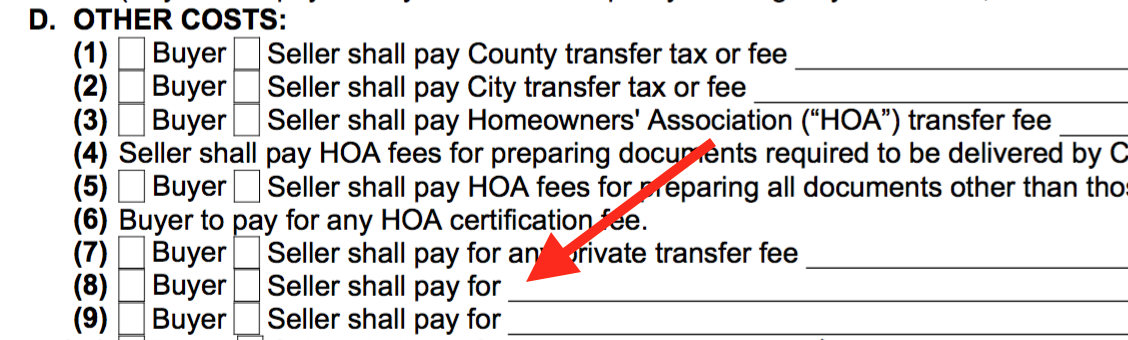

(Transcription) This concept was popularized and entered the mainstream over ten years ago and since then it’s evolved and has changed somewhat. Before 100 percent commission was part of the mainstream program that an agent could get a real estate company. The big talk was about splits, so an agent, let’s say a new agen,t would join a company and they would get 50% and then the company would get 50%, so that would be a 50/50 split. As the agent progressed, they might get 60% or 70%. Companies would recruit agents based on an 80/20 split or 90/10 split and then hundred percent commission entered the mainstream and said here’s a flat fee per transaction and you keep the rest of the commission we don’t care how much the Commission is you just pay a low flat fee. There was also another version of that where the flat fee could have been an annual fee so an agent would pay a fee of let’s say three thousand dollars at the beginning of the year and then the agent would keep the Commission that they earn 100% of the Commission they earn on all the transactions they closed that year. Over time I think that this concept has kind of evolved and changed and companies have looked to find ways to increase revenue and still be within that hundred percent commission model. What that term encompasses now are companies that often charge a monthly fee, so there might be a monthly fee in addition to the transaction fee. Often these companies will charge for errors omissions insurance you know so there might be a risk management fee on each transaction or the agent might have to pay quarterly or semi-annually for their insurance, there might be fees for high-risk transactions or a fee for having access to the office or having a key, basically there are other fees. So if you’re looking at a hundred percent commission brokerages, it’s important that you clarify any and all fees that you could infer working at that office. With Balboa Real Estate over the years, we’ve experimented with hundred percent commission programs to find what would be the best, the least expensive to agents so agents can save more of the commission that they make and of course the company can stay profitable, we have done a flat fee per transaction and we’ve done the annual fee where agents pay the annual fee, and and then get a hundred percent of what they earn, and we’ve always paid errors emissions on behalf of the agent. We’ve never had agents have to pay theirs separately. So we we found that in certain situations where the sales price was very high our E&O; bill would go up because it was how the insurance was assessed, based on the revenue commission, revenue of a transaction. We had agents that were closing three, four, five million dollar properties and making these commissions that go along with it that would increase our E&O bill and we were still charging a very low flat fee. Which would essentially make the company take a loss on those transactions so certainly we can’t stay in business taking a loss on those transactions, but we want to be the lowest cost one hundred percent commission company so we camp with a plan that we implemented over a year ago, that’s been working quite well. Our commission plan is a flat fee per transaction that is ten basis points of the sales price. So the easy math on that is if the sales price is seven hundred thousand dollars, then the flat fee per transaction is seven hundred dollars to the brokerage and the agent will keep everything else. If the sales price is eight hundred thousand then the flat fee to the brokerage is eight hundred dollars. Again, the agent keeps everything else, Balbo real estate pays the errors and omissions insurance for the agents. There are no other fees involved, just a simple flat fee per transaction to keep it very easy to understand and low cost as well. then of course if you have a very high sales price it allows the flat fee to the company to go up just enough to cover the E&O insurance on the agents behalf. If you’re interested in our Commission model, what we believe to be the best hundred percent commission model in the industry, please CLICK HERE