If you are a real estate agent looking for a brokerage that offers you the flexibility to keep more of your commission, a 100% commission brokerage might be the right  fit for you. In this type of brokerage, agents keep the entire commission earned from a transaction, minus a fixed fee or percentage paid to the brokerage.

fit for you. In this type of brokerage, agents keep the entire commission earned from a transaction, minus a fixed fee or percentage paid to the brokerage.

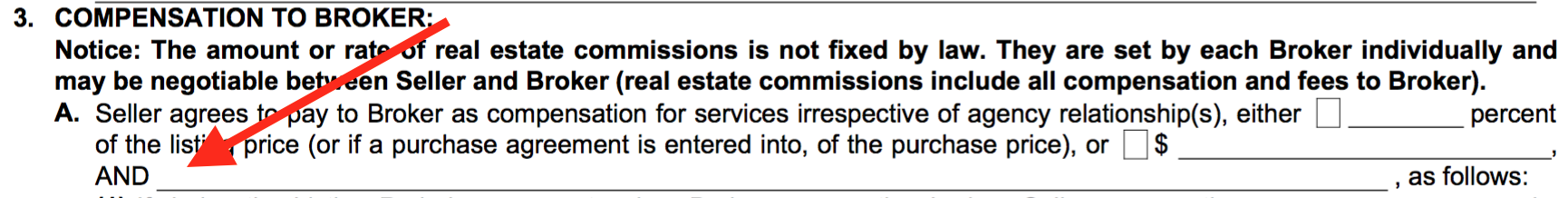

The traditional brokerage model, on the other hand, typically takes a percentage of the commission earned by the agent, leaving them with a smaller share of the earnings. This percentage can range from 50% to 70% depending on the brokerage.

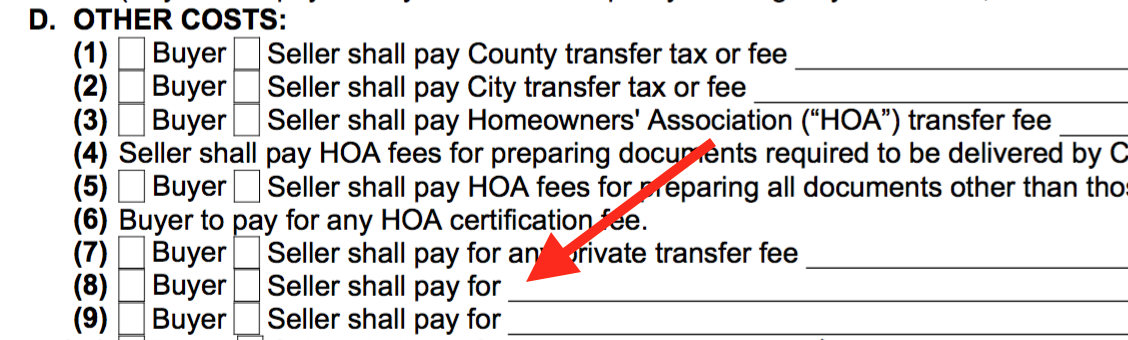

In a 100% commission brokerage model, agents are responsible for their own expenses such as marketing, office space, and technology. In return, they receive the entire commission earned from a transaction, minus a fixed fee which is usually lower than the percentage taken by traditional brokerages.

Experienced agents who can generate their own leads and close deals without relying on the brokerage’s support services may find 100% commission brokerages more attractive. However, newer agents who require more support and guidance may not benefit as much from this model.

It’s essential to note that different 100% commission brokerages have varying structures and fees. Therefore, agents should review and compare the options available to determine which brokerage model best suits their needs.

In conclusion, a 100% commission brokerage offers agents the potential to keep more of their hard-earned commissions. As an agent, it is crucial to understand the pros and cons of different brokerage models and choose the one that aligns with your business goals and needs.

CLICK HERE to view our 100% commission model