When is a seller exempt from the Transfer Disclosure Statement?

Sometimes sellers wrongly assume they are exempt from furnishing the buyer with a transfer disclosure statement (TDS) because the home is owned by a corporation, LLC, or trust.

The Transfer Disclosure Statement (TDS) is required in the state of California unless the seller (or transferor) meets one of the following conditions:

- Court-ordered sales such as probate sales, foreclosure sales, sale by bankruptcy trustee, eminent domain.

- Transfers in which the property goes back to the bank because the borrower defaulted on the mortgage.

- When the seller is the fiduciary administering a trust*, guardianship, conservatorship or estate.

*A trustee is not exempt if the trustee ever owned the property before it was moved into a trust OR occupied the property in within a year leading up to the sale.

- Sales from one co-owner to co-another

- Sales from one spouse to another or lineal blood-relative.

- Seller is a government entity.

Property held in a trust is commonly misunderstood. Just because the seller is a trust, does not make the trustee exempt from completing a TDS.

Sellers get flustered when they don’t live in the property and have to fill out a Transfer Disclosure Statement. The reason is that they don’t know the answer to many questions and they don’t want to put the wrong information. This is common with landlords or people selling homes they haven’t occupied recently or even ever.

Should sellers that don’t occupy a property fill out a transfer disclosure statement? Yes, unless they are exempt for one of the reasons above, the seller has to by law. Whether the seller occupied is irrelevant.

A seller doesn’t get in trouble for “not knowing.” This means if the seller didn’t know if there was a roof leak and they checked “no,” and the buyer then finds a roof leak, the seller did not misrepresent the condition – at least not intentionally. A seller gets in trouble when they knowingly withheld information from the buyer. If a seller is filling out a Transfer Disclosure Statement and doesn’t know if there is a leak, then the answer should be “no.” The disclosure is asking if the seller knows. It’s less about the property and more about the seller’s knowledge as it relates to the property.

What about the Exempt Seller Disclosure (ESD)?

There is no legal requirement for a truly exempt seller to provide an exempt seller disclosure form. There is no legal requirement for a Seller Property Questionnaire. These forms exist because CAR (The California Association of Realtors) knows that the more the seller the discloses the safer they are. So, even though a seller is exempt. There is a condensed ESD form that is suggested to be used instead of nothing. This offers protection to the buyer and seller.

I think CAR’s heart is in the right place with the exempt seller disclosure. I personally recommend taking it further. I think that any natural person selling a property should just fill out a transfer disclosure statement. The more that is disclosed the better.

The original code for reference.

(a) Sales or transfers that are required to be preceded by the furnishing to a prospective buyer of a copy of a public report pursuant to Section 11018.1 of the Business and Professions Code and transfers that can be made without a public report pursuant to Section 11010.4 of the Business and Professions Code.

(b) Sales or transfers pursuant to court order, including, but not limited to, sales ordered by a probate court in the administration of an estate, sales pursuant to a writ of execution, sales by any foreclosure sale, transfers by a trustee in bankruptcy, sales by eminent domain, and sales resulting from a decree for specific performance.

(c) Sales or transfers to a mortgagee by a mortgagor or successor in interest who is in default, sales to a beneficiary of a deed of trust by a trustor or successor in interest who is in default, any foreclosure sale after default, any foreclosure sale after default in an obligation secured by a mortgage, a sale under a power of sale or any foreclosure sale under a decree of foreclosure after default in an obligation secured by a deed of trust or secured by any other instrument containing a power of sale, sales by a mortgagee or a beneficiary under a deed of trust who has acquired the real property at a sale conducted pursuant to a power of sale under a mortgage or deed of trust or a sale pursuant to a decree of foreclosure or has acquired the real property by a deed in lieu of foreclosure, sales to the legal owner or lienholder of a manufactured home or mobilehome by a registered owner or successor in interest who is in default, or sales by reason of any foreclosure of a security interest in a manufactured home or mobilehome.

(d) Sales or transfers by a fiduciary in the course of the administration of a trust, guardianship, conservatorship, or decedent’s estate. This exemption shall not apply to a sale if the trustee is a natural person who is a trustee of a revocable trust and is a former owner of the property or was an occupant in possession of the property within the preceding year.

(e) Sales or transfers from one co-owner to one or more other coowners.

(f) Sales or transfers made to a spouse, or to a person or persons in the lineal line of consanguinity of one or more of the transferors.

(g) Sales or transfers between spouses resulting from a judgment of dissolution of marriage or of legal separation or from a property settlement agreement incidental to that judgment.

(h) Sales or transfers by the Controller in the course of administering Chapter 7 (commencing with Section 1500) of Title 10 of Part 3 of the Code of Civil Procedure.

(i) Sales or transfers under Chapter 7 (commencing with Section 3691) or Chapter 8 (commencing with Section 3771) of Part 6 of Division 1 of the Revenue and Taxation Code.

(j) Sales or transfers or exchanges to or from any governmental entity.

(k) Sales or transfers of any portion of a property not constituting single-family residential property.

(l) The sale, creation, or transfer of any lease of any duration with the exception of a lease with an option to purchase or a ground lease coupled with improvements.

Et tu, MLS?

Were you there before the Multiple Listing Service “MLS” became the web-based platform it is now? I started in real estate right before the transition occured. The old MLS was accessed on the DOS computer system, you know, the black screen with the green letters. Real estate agents would punch in codes for their propery search and find listings. Then they  would print on that old-school computer lab paper with the perforated edges that you could tear off. There you had it, a list of properties for sale or comparables for your client – and your client depended on you to access this coveted data. You were the gatekeeper to all this cyptic information. The list of comparables or duplexes for sale made you a very valuable consultant. What came next for the industry would change an agent’s value radically.

would print on that old-school computer lab paper with the perforated edges that you could tear off. There you had it, a list of properties for sale or comparables for your client – and your client depended on you to access this coveted data. You were the gatekeeper to all this cyptic information. The list of comparables or duplexes for sale made you a very valuable consultant. What came next for the industry would change an agent’s value radically.

When I first saw listings posted online they looked beautiful. It was probably what seeing color TV for the first time felt like. No more green text codes, it was in an easy-to-read format with nice pictures. This was the beginning of our current era. Over the years, all of these fragmented and individually-owned MLSs would transition into more tech-friendly platforms. Then consolidation and data-sharing began. Fifteen years ago, there were several MLSs in the greater Los Angeles area, and data was not shared like it is now. I bounced back between Sandicor -the San Diego MLS, and SoCal MLS, which was the main MLS in Orange County. If I had out-of-area listings, then I had to do a reciprocal listing agreement with the other MLS and pay a fee for my listing to show up on the respective local MLS.

As the MLSs evolved, so did data-sharing. Listing data was fed to outside tech companies that would pay for it. Why, because consumers began looking at the internet for everything, so why wouldn’t real estate listings be on there as well. Naturally, with multiple tech companies trying to give consumers the best or most informative real estate experienced online, it started a race to offer the most data in the best format. This made a pivotal change to the industry. Consumers no longer needed agents for property information. They could go online and get it from tech companies. These companies became consumers of raw MLS data. MLS companies harvest that data from agents. We agents are like honey bees collecting nectar for the hive.

I always found the fragmentation of MLSs and local boards of realtors annoying. I liked CRMLS because I thought their platform was user friendly and their plan was  ambitious. They wanted to grow and do data shares with surrounding MLSs, which makes it easier for agents like us. If you work in Orange County but happen to take a listing in Riverside or San Diego, or even Ventura County, you can input that listing and it will show up in the same pool of data. This growth has been working great until a recent uptick of MLS fines signaled a stark change in the MLS relationship.

ambitious. They wanted to grow and do data shares with surrounding MLSs, which makes it easier for agents like us. If you work in Orange County but happen to take a listing in Riverside or San Diego, or even Ventura County, you can input that listing and it will show up in the same pool of data. This growth has been working great until a recent uptick of MLS fines signaled a stark change in the MLS relationship.

MLS Syndication

Before I talk about MLS fines, I should acknowledge the first big MLS controversy. Many agents knew that if consumers didn’t need them for access to MLS data then it would damage an agent’s value.In other words, it makes an agent more valuable if they can be the gatekeeper to MLS data. After all, you, the agent, are the person inputting the information. It’s your listing. The MLS was intended to be a database for professionals, not a data harvesting center. That said, many micro-movements have erupted to prevent or at least control whether listings are syndicated from the private MLS to all these publicly-facing tech companies. Here’s the catch though, that cat is out of the bag. Consumers, including homesellers want their listing syndicated to every tech company site imaginable. Plus, many agents have embraved this reality and market through these tech companies, ie Zillow Premier agent. I can tell you as a broker that nearly every client demands that their listing show up on Zillow or realtor.com. Pandora’s box was opened, the notion of not syndicating listing is not practical. The movement has and will go nowhere. As far as I’m concerned the case is closed on this. However, there is a new issue emerging.

Exorbitant MLS Fines

Remember, I have been a big supporter of CRMLS, but they have changed. I did a podcast episode on monopolies, which was inspired by CRMLS the biggest MLS in the nation. A few years ago, if there was an issue with the data entered into the MLS by an agent, CRMLS would send a warning email. If there was a mixup, there was a data integrity department, even someone you could call to help sort it out. I don’t know when the transition occured, but I assume it was spawned by a board of directors meeting. The CRMLS has a ruthlessly zero tolerance standpoint for data integrity. I first discovered this when an agent at Balboa Real Estate was fined a whopping $1500. What grave mistake did he make? Well, he took a screenshot of a google map showing the proximity of his listing to local shopping and added it to the library of images for his listing. Naturally, when told to remove the map image, he complied, but it was too late. The fine had been assessed. NO EXCEPTIONS. Here is the text you can expect if you seek a penalty waiver:

Unfortunately, CRMLS staff does not have the authority to waive or reduce any fine, as the amount of the fines is set by the CRMLS board of directors. If you wish to contest the issuance of Citation# xxxx-xxxxx, you may do so by filling out and submitting the Citation Review Request Form, located here: https://go.crmls.org/crmls–

citation-review-request/

Hey, it’s not up to CRMLS, the fine was set by the board. An ambigous group, many non-employees, that meet when, quarterly? So, if you were hoping to talk to a manager or something, well, sorry, tough luck. No one that works there has a say in the matter. In contrast, how much is a red light ticket? You know, an infraction that could kill people…generally ~$490. So, yeah, $1500 seems totally reasonable, yes I’m being sarcastic.

But wait, you can contest the violation – for $200. If you lose, you are out $1700 now! A local board recently told a Balboa agent she has only seen once person successfully overturn their fine. Just once. The odds are not in your favor. It’s a terrible $200 bet. You probably have better odds taking that $200 to a casino and winning the $1500 needed to pay the fine. than successfully contesting the violation.

If the average real estate agent makes $46,000 then a $1500 fine is 3.26% of the agent’s annual income, or 39% of that agent’s monthly income. What is the MLS thinking? The ostensible answer is they want to maintain strict criteria to ensure unblemished data. However, the penalty is unnecesary. All they have to do is suspend the listing. If they place the listing on hold then the agent will panic to fix the issue. If the agent is still uncooperative after a warning measure THEN assess a fine. Preferrably a figure more based in reality.

Not just one Balboa agent has been assessed the $1500 fine, but three have.

As an example of the most recent case. A Balboa agent had a lease listing. He asked the former listing agent if he could use his pictures for the lease listing. The former listing agent was cooperative. In fact, he was happy to agree, in writing, for the Balboa agent to use the pictures. The Balboa agent, appreciative of the favor, simply downloaded the pictures from the former listings and added them to his listing. Again, this was done with the other agent’s written permission. Perhaps it was the CRMLS watermark added to pictures, but something triggered a violation, in which the Balboa agent was accused of the unauthorized reproduction. Naturally, the Balboa agent contacted CRMLS to furnish them with a copy of the permission and clear up the misunderstanding. Not so fast, there is a process remember? This agent must apply for a citation review and pay $200 with no guarantee of repealing the penalty fee of $1500.

Now What?

What can you do? MLSs are growing bigger and consolidating when possible. When there is competition, a business must be courteous or else their customer will leave. Most MLSs, namely CRMLS don’t need to be courteous, few agents will bother to leave. They have become big enough to make the customer dispensable. There are so many of us, or at least enough of us with limited options that they don’t NEED to factor in the agent’s point of view very much. They can do as they please and funnel the agent through whatever policy labyrinth they construct. In summary, when a MLS gets so big that they are almost monopolistic, we get the benefit of expanded coverage. If things go wrong, we are left with few options. In this case, the outrageous penalties are the dark side of the otherwise useful MLS expansion. All I can say is be very careful not to violate the MLS policy and procedures. Contact me, ask me to double-check your listing draft, and don’t, for a second, think the MLS is your friend.

What is The Earnest Money Deposit?

Also, called the “EMD,” this is a good-faith deposit the buyer places into escrow at the beginning of the transaction. This gesture shows the buyer’s seriousness and is also at risk of being lost if the buyer breaches contract. A typical earnest money deposit is 1% to 3% of the sales price. The EMD is not refunded but rather applied to the funds needed to close escrow. For example, if the down payment of the purchase price is $100,000 then the buyer will just need to give escrow $90,000 before closing. This is because there is already a $10,000 deposit sitting in escrow.

Can I get My Earnest Money Deposit Back?

In California, the standard residential purchase agreement has buyer contingency periods. This is a certain amount of time allocated to the buyer to perform inspections or gets a loan. For example, you have 17 days from acceptance to do property inspections. If you decide the property requires too much work then you can cancel in that timeframe and are entitled to a refund of your earnest money deposit. Basically, a good rule of thumb is that if you cancel within any contingency period, your earnest money deposit is refundable.

What Happens If I Cancel After Contingency Periods?

Let’s continue our example where you’re a buyer. Now imagine all your contingencies run out on day 21. Then on day 22 you decide to cancel. Is your earnest money refundable? Maybe, I will explain. The standard in California is that the buyer must remove contingencies in writing or else they stay in effect. So, even if your longest contingecy period expires on day 21 after acceptance, it will continue indefinitely until you send the seller a written removal of contingencies. This means that as long as you didn’t remove your contingencies, your earnest money deposit is refundable.

What If I Remove Contingencies and Cancel?

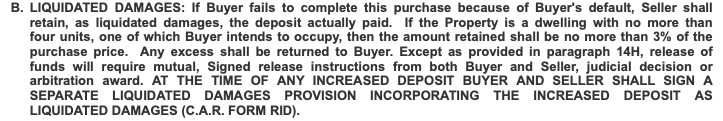

Once you remove your contingencies it is assumed that your deposit is non-refundable. If you try to back out, the seller will likely ask you to surrender your deposit. If you refuse, the seller can make a claim or even take you to court to get an order for escrow to release the deposit as “liquidated damages.” The contract has a section that states the seller can keep the deposit up to 3% of the sales price as penalty for the buyer’s breach. Now, this doesn’t happen that often. Usually the parties will negotiate a reduced fee, like the seller might get half the earnest money deposit. Often the seller will not want the hassle and just refund the earnest money deposit so that they can move on with a backup buyer.

How Do I Get The Deposit Out of Escrow?

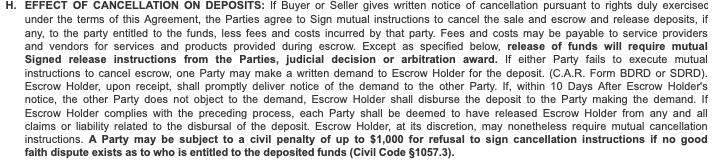

A seller that feels entitled to the deposit or a buyer that feels a refund is deserved will try to get escrow to release the deposit. Escrow cannot release the deposit without instructions signed by both the buyer and seller or a court order from one of the parties. If one party cancels due to the other party’s breach, they can demand the deposit. The purchase contract stipulates that a party can send a demand to release to escrow, and then escrow will give that demand to the other party. If the other party does not object to the demand to release deposit adfter 10 days, then escrow can release the deposit to the party that made the demand. Most parties will dispute the other party’s demand. This means the parties eather have to negotiate an agreement to release the deposit or escalate the matter to mediation/arbitration, or court.

What Happens If The Seller Refuses to Release The Buyer’s Deposit?

Neither party is allowed to hold the earnest money deposit in bad faith. This means that without a valid, reasonable claim the deposit should be released as soon as possible. Unless their is a good-faith dispute, a party must return the deposit within 30 days of receiving a written demand from the other party. Failure to return the deposit can result can result ina civil penalty up to $1000 per California Civil Code § 1057.3.

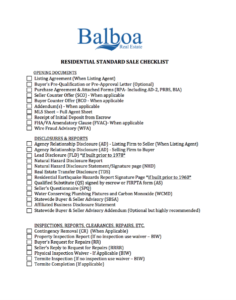

What Real Estate Forms Are Required on a Transaction Checklist?

Any reputable California real estate brokerage is going furnish their agents with a closing checklist with all the documents needed to complete the file. It’s important to note that what a brokerage requires and what is legally required are two different things. The California Association of Realtors makes additional forms that are designed to get the seller to disclosure more and reduce liability. Many brokerages add excessive forms to their transaction checklist because they don’t know any better. This creates redundant forms and unnecessary amount of paperwork. It’s our opinion at Balboa Real Estate that the broker should seek to cover the broadest spectrum for their clients while utilizing the least amount of forms. Basically, to create a transaction checklist that is extremely efficient.

Any reputable California real estate brokerage is going furnish their agents with a closing checklist with all the documents needed to complete the file. It’s important to note that what a brokerage requires and what is legally required are two different things. The California Association of Realtors makes additional forms that are designed to get the seller to disclosure more and reduce liability. Many brokerages add excessive forms to their transaction checklist because they don’t know any better. This creates redundant forms and unnecessary amount of paperwork. It’s our opinion at Balboa Real Estate that the broker should seek to cover the broadest spectrum for their clients while utilizing the least amount of forms. Basically, to create a transaction checklist that is extremely efficient.

So What Forms Should Be On A Transaction Checklist?

RESIDENTIAL STANDARD SALE CHECKLIST

OPENING DOCUMENTS

Listing Agreement (When Listing Agent)Buyer’s Pre-Qualification or Pre-Approval Letter (Optional)

Purchase Agreement & Attached Forms (RPA- Including AD-2, PRBS, BIA) Seller Counter Offer (SCO) – When applicable

Buyer Counter Offer (BCO – When applicable

Addendum(s) – When applicable

MLS Sheet – Full Agent Sheet

Receipt of Initial Deposit from Escrow

FHA/VA Amendatory Clause (FVAC)- When applicable

Wire Fraud Advisory (WFA)

DISCLOSURES & REPORTS

Agency Relationship Disclosure (AD) – Listing Firm to Seller (When Listing Agent) Agency Relationship Disclosure (AD) – Selling Firm to Buyer

Lead Disclosure (FLD) *if built prior to 1978*

Natural Hazard Disclosure Report

Natural Hazard Disclosure Statement/Signature page (NHD)

Real Estate Transfer Disclosure (TDS)

Residential Earthquake Hazards Report Signature Page *if built prior to 1960* Qualified Substitute (QS) signed by escrow or FIRPTA form (AS)

Seller’s Questionnaire (SPQ)

Agent Visual Inspection Disclosure OR Agent Inspection Noted on Page 3 of TDS.

Water Conserving Plumbing Fixtures and Carbon Monoxide (WCMD)

Statewide Buyer & Seller Advisory (SBSA)

Affiliated Business Disclosure Statement

Statewide Buyer & Seller Advisory Addendum (Optional but highly recommended)

INSPECTIONS, REPORTS, CLEARANCES, REPAIRS, ETC.

Contingency Removal (CR) (When Applicable)

Property Inspection Report (If no inspection use waiver – BIW) Buyer’s Request for Repairs (RR)

Seller’s Reply to Request for Repairs (RRRR)

Physical Inspection Waiver – If Applicable (BIW)

Termite Inspection (If no inspection use waiver – BIW) Termite Completion (If applicable)

TITLE & ESCROW

Escrow Instructions (Unsigned OK)

Preliminary Title Report

Home Warranty Plan Confirmation (When applicable)

CLOSING DOCUMENTS, TASKS TO COMPLETE

Closing Statement

Verification of Property Condition (VP) AKA Final Walk Through

Copy of Commission Check

Local Disclosures (When Applicable)

Any Additional Documents Used in Transaction

If you have questions or comments then please contact info@balboateam.com

Limited Function Referral Office Certification or LFRO is a designation for real estate licensees that aren’t members of the association of realtors, but want to hang their license with a broker that is a full realtor member. The implication is that the non-member agents is considered a “referral agent” and they are not expected to operate as an active agent. Instead, they are expected to refer their clients to “active” realtors on the team.

Once a salesperson is licensed with the Department of Real Estate, the salesperson is not required to join an association of realtors. Some licensees maintain their license as NBA or no broker affiliation. Salespersons must be affiliated with a broker to conduct business.

So, a salesperson might go hang their license with a broker, this is where there may or may not be a requirement. A broker is very likely to be a full realtor member with an association of realtors. Now, the distinction is the the association requires the broker’s salespersons to be full realtor members as well. It has nothing to do with the state. It’s a stipulation of the broker’s membership with the association of realtors. If the salesperson doesn’t sign up as a full realtor member then the broker will get a notice that they must either pay a fine, or the agent can be moved to LFRO designation upon Limited Function Referral Office Certification, or the licensee must be terminated from the broker’s employment. The obvious choice is for the salesperson to be moved to the LFRO referral agent status.

Occasionally, agents will inquire with Balboa Real Estateabout the 100% commission program. They ask whether or not they are required to be a member of the association of realtors. Our answer is that the agent is not required because we can have their DRE license active with our company and move the agent to LFRO referral agent status. However, when an agent begins to get busy, it would benefit them to pay dues to access a MLS and professional real estate forms.

Many agents ask if Errors and Ommission Insurance (E&O) insurance is required by law. A real estate broker, once licensed by the Department of Real Estate, can broker real estate sales without E&O insurance. They aren’t required by law to have a policy, but any legitimate professional would not conduct business without E&O insurance. So, while an E&O requirement isn’t enforced by the state, it’s still an unoffical requirement to properly conduct real estate brokerage. The implications of listing and selling real estate without E&O insurance are catastrophic. Also, clients deserve to have an agent that is insured.

Now, since we have established that E&O insurance is needed, let’s talk about cost. If you are a lone or independent broker you simply need to call an insurance company and tell them that you need a policy and they will send you a quite for hundreds or maybe thousands of dollars (based on your sales volume) for a year-long policy. For most agents that hang their license with a brokerage, the company has a blanket policy that covers the agents. Every type of transaction, residential, commercial, agent-owned, dual agent, sales price….you name it, affects the cost of the company’s E&O insurance policy. Most companies pass this fee on to the agents in the form of a per transaction risk assessment for, or some sort of charge assessed randomly. Either way, agents have to come up with money to pay a fee for E&O Insurance. This is one important way that Balboa Real Estate is different than other real estate brokerages. Our E&O insurance is included in our transaction fee. This means that agents do not have to pay anything additional out of pocket for E&O insurance. It’s included in our flat fee plan. So, if you want to avoid paying an E&O insurance fee then join a brokerage that pays it for all the agents, might we suggest Balboa Real Estate?

Learn more about Balboa Real Estate’s 100% commission plan here.

Have you heard of a non-independent broker escrow company, also known as a broker-controlled escrow? These are different from other escrow companies, and I’ll explain the difference. To conduct escrow business in the state of California, you must have a license. Interestingly, there are three different types of licenses that allow you to perform escrow. The reason there are three is because there are three different licensing bodies that oversee escrow activity.

- The Department of Insurance.

- The Department of Business Oversight.

- The Department of Real Estate.

Naturally, one license is harder than another to obtain. The Department of Insurance license is basically for title companies that have escrow divisions. This is an expensive and very regulated license to have and maintain. My personal opinion is that title companies are the safest places to have escrow conducted.

The Department of Business Oversight is for independent escrow companies. For example, let’s say an escrow officer that worked at a title company wanted to start her own escrow company. She could start an independent escrow company by obtaining a license through the dept. of business oversight. She would have to show 5 years of escrow experience for her escrow manager, maintain liquid asset reserves, pay into a surety bond to protect consumers, and have her financials audited, among many other screening mechanisms designed to maintain safety standards for the escrow company.

So where does the non-independent broker escrow fit in? A non-independent broker controlled escrow is licensed by the Department of Real Estate (DRE). However, there isn’t a special escrow license issued by the DRE. The license needed to conduct escrow is just a real estate broker license. This means that if you are a real estate broker you can open up an escrow trust account and, just like that, have an escrow company. While the the other types of licenses require all sorts of protections, assets, and audits, you can skip that as a non-independent escrow company. To be clear about how low the barrier of entry is, a real estate broker can file a “doing business as” (DBA) name i.e.. “Wild West Escrow – a non-independent broker escrow,” with the Department of Real Estate, then open an escrow trust account, and they are now ready to accept your wire transfers. This real estate broker is now in complete control of an account with people’s life savings swirling around in it.

What happens if an escrow officer makes a mistake at an non-independent escrow? Let’s say the escrow officer accidentially wires the seller’s equity money to a fraudulent account – it happens – then what? Does the non-independent escrow company have cash reserves to remiburse the seller- provided they would even be willing? Because there is no requirement to have reserves. Remember, a broker licensee started this company by registering the name and opening a business/trust bank account. However, there are zero guarantees that if something goes wrong they will have the means to fix it or even the obligation if they did.

A personal contact confided that she sold their home with a non-independent broker escrow and their sale proceeds were wired to a fraudulent account. She went after the escrow company and they settled for pennies on the dollar.

Additionally, escrow is supposed to be a neutral third-party. However, if one of the brokers in a real estate transaction controls the escrow and represents one of the parties, then that is a conflict of neutrality. The other party is supposed to trust that the other party’s broker will conduct escrow in a neutral manner.

A non-independent broker escrow company should always be avoided. Considering that credible, safe escrows are often cheaper and easily accessible, it’s extremely poor judgement to settle for a non-independent broker escrow company . We highly suggest using a title company for title/escrow because it’s safe and efficient. Second to that, an independent escrow company licensed through the Department of Business Oversight.

Recent Posts

Contact

Tel. 888.787.8808

info@balboateam.com

Main Office: 5256 S. Mission Rd. Suite 123

Bonsall, CA 92003